HouseofCompanies.io provides businesses with essential resources and expertise for seamless international VAT compliance. Whether you’re a local start-up expanding internationally or a global corporation entering new markets, understanding VAT registration requirements and simplifying the process is essential to your success. Let us help you navigate these complexities with confidence.

VAT compliance can be challenging, especially for businesses engaged in international trade. House of Companies offers tailored support to help you handle Austria’s VAT requirements with ease. Whether it’s using the One Stop Shop in Europe, applying the Reverse Charge Mechanism, or obtaining the Article 23 Exemption to avoid VAT on imports, we provide the expertise you need.

At House of Companies, we aim to make VAT registration and filing seamless and stress-free for global entrepreneurs like you. In addition, we offer two supplementary services designed to simplify your VAT journey even further

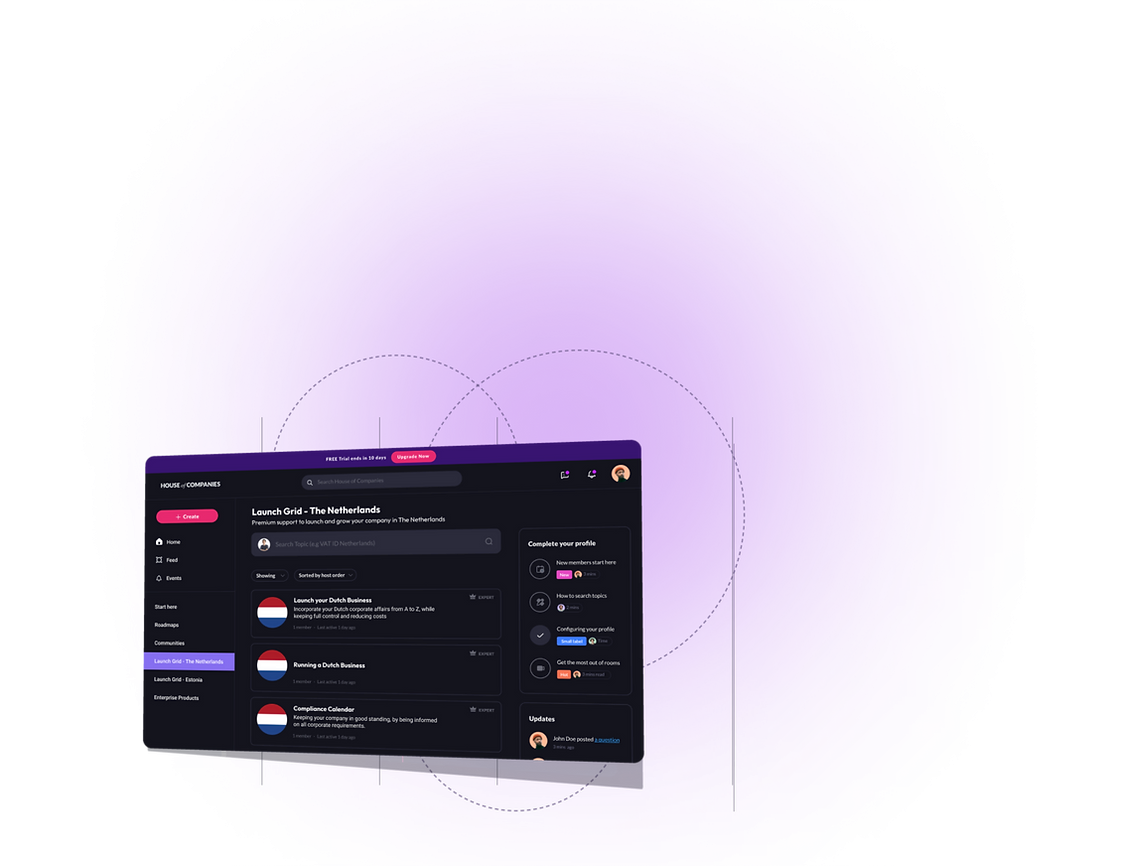

HouseofCompanies.io is an innovative platform designed to streamline and simplify the VAT registration journey. This intuitive business portal offers a comprehensive view of all milestones needed to activate your VAT number, making global expansion smoother than ever. With a blend of advanced technology and a dedicated team of VAT experts, HouseofCompanies.io delivers a one-stop solution for businesses aiming to grow internationally.

"Expanding our business into Europe was a breeze thanks to their services. The VAT application process was fast and straightforward."

John MCEO of GlobalTrade

John MCEO of GlobalTrade"Excellent customer service! They helped us every step of the way, especially with compliance and Dutch tax regulations."

Maria KDirector of Finance, Tech Ventures

Maria KDirector of Finance, Tech Ventures"Setting up a new entity in the Netherlands was daunting, but they made it hassle-free. I highly recommend their services."

Ahmed SManaging Director

Ahmed SManaging Director

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!