At HouseofCompanies.io, we streamline VAT Registration and filing for businesses expanding into Austria. Our expertise equips you with essential knowledge and tools to efficiently manage international VAT compliance and equips businesses with vital knowledge and tools to deal with Austrian VAT compliance efficiently. Whether you're a startup venturing into Austria for the first time, or a multinational corporation exploring new opportunities, understanding the necessity and impact of VAT registration in Austria is crucial.

VAT can be complicated, especially when you trade in Austria. We can help you apply the One Stop Shop in Europe, understand the Reverse Charge Method, or obtain the Art. 23 Exemption to avoid VAT on your imports into Austria.

If you have specific questions about your VAT situation in Austria, our team of experts can provide you with a customized Advisory Report. This report will offer insights and recommendations tailored to your business, helping you make informed decisions and optimize your VAT compliance strategy in Austria.

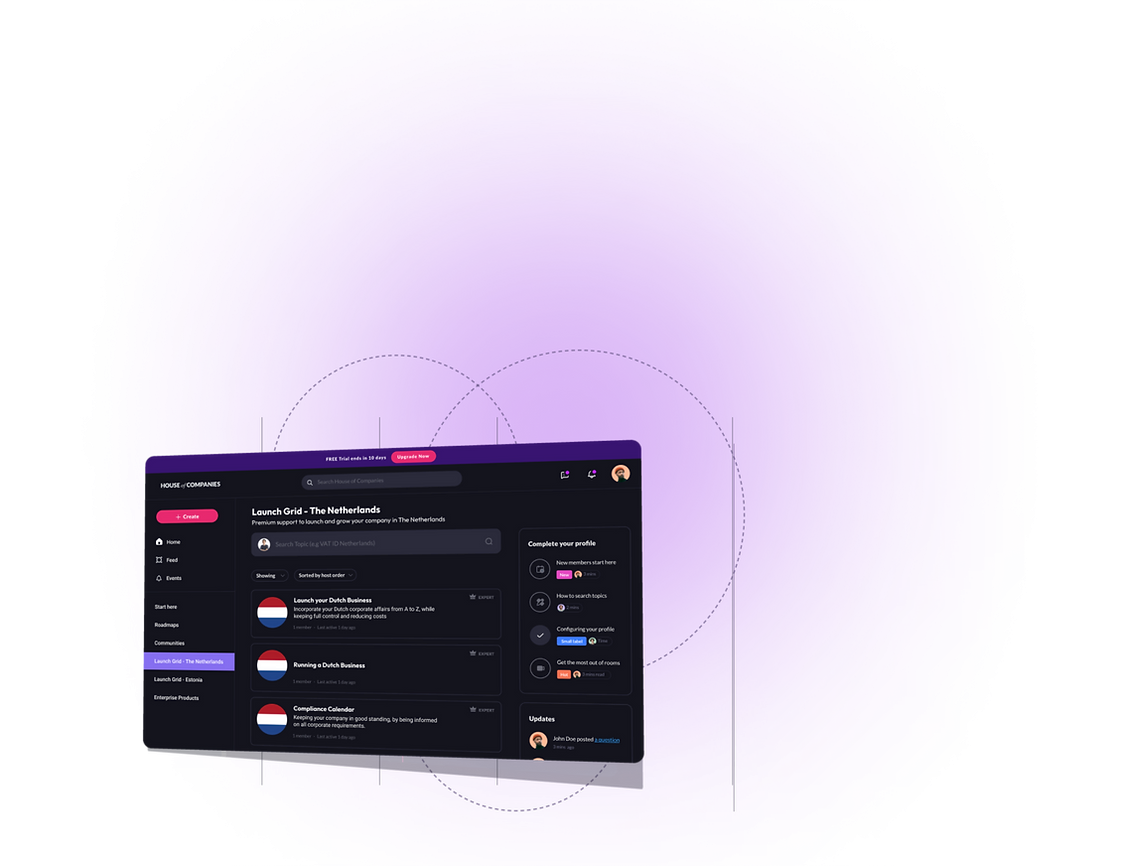

Our Business Portal provides an overview of all milestones towards activation of your VAT Number in Austria. HouseofCompanies.io is a game-changing platform designed to streamline and simplify the VAT registration process in Austria. This innovative business portal provides a one-stop solution for companies looking to expand their operations in Austria.

"I got my Austrian VAT ID application sorted without having a local entity, or even an accountant"

Anna Polinski

Anna Polinski"I wanted a VAT number in Austria, and no local company. With limited transactions, I needed no accountant, and the Launch Grid helps me file all returns easily!"

Asala

Asala"I needed a VAT ID to deal with Amazon in Austria, and the result is perfect"

Markus Bloom

Markus Bloom Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!